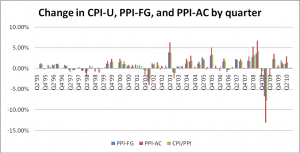

The general price level in 2010 relative to 2009 shows average price levels that are nearly flat. The reason for this trend is significant commodity price increases in 2007 and 2008 that collapsed after the global financial crisis. Much of the reason for the price volatility in commodities is leveraged buying and selling through hedge funds that drove prices up during the bubble and precipitated a price crash after the bubble collapsed as many entities were simultaneously deleveraging their positions. To demonstrate this phenomenon, we have graphed the Consumer Price Index for Urban residents (CPI-U), Producer Price Index for Finished Goods (PPI-FG) and Producer Price Index for All Commodities (PPI-AC) from 1995 up to the present time.

The general price level in 2010 relative to 2009 shows average price levels that are nearly flat. The reason for this trend is significant commodity price increases in 2007 and 2008 that collapsed after the global financial crisis. Much of the reason for the price volatility in commodities is leveraged buying and selling through hedge funds that drove prices up during the bubble and precipitated a price crash after the bubble collapsed as many entities were simultaneously deleveraging their positions. To demonstrate this phenomenon, we have graphed the Consumer Price Index for Urban residents (CPI-U), Producer Price Index for Finished Goods (PPI-FG) and Producer Price Index for All Commodities (PPI-AC) from 1995 up to the present time.

One of the complexities implicit within consumer prices is the duality that exists between commodity products that naturally inflate with increases in the supply of money from the Federal Reserve and technology products that naturally deflate in price as new innovations displace current products with higher quality and lower prices. When we published the 2010 inflation predictions, our models assumed that the quantitative easing being undertaken by the Federal Reserve would ripple through the economy and drive up consumer prices. Our 2010 forecasted rate of inflation was 3.9% for core inflation and 7.2% for all items. The reported inflation through the month of October is 0.8% for core inflation and 1.1% for all items. It is quite apparent that the experienced inflation through October is quite lower than our prediction. The reason for this is that our prediction was based on an assumption that a dramatic increase in bank reserves after the financial collapse of 2008 would eventually spill out into the broader economy. However, the Federal Reserve successfully kept these reserves out of circulation by lowering the “Fed Funds” rate for bank borrowing from the Federal Reserve down to nearly zero. This made it more profitable for banks to borrow from the Fed and use those borrowed funds to purchase Treasury notes than to loan their reserves out. This technique has resulted in steadily printing more money to fund the bank arbitrage of Treasuries, but has also been able to keep the excess reserves from inflating the supply of money in the marketplace.

As 2011 unfolds, we expect to see commodities inflated by the “quantitative easing” on the part of the Federal Reserve. This is expected to result in an inflation rate of 2.4% for all items excluding food and energy and a 6.6% rate of inflation for all items in the index. These predictions are based on the assumption that techniques used by the Fed to constrain monetary inflation will see their effectiveness diminish in 2011. The spillover effect from quantitative easing are already being felt in prices for food and energy. We view this as an indicator that recent increases in the money supply are finding their way into the broad economy and influencing prices. In the event that large amounts of new money are unleashed into circulation over a short period of time, there is a considerable risk of price spikes. However, it is extremely difficult to know exactly when such an event will occur, because of the existence of large excess reserves that have been sitting on bank balance sheets for an extended period of time.

As 2011 unfolds, we expect to see commodities inflated by the “quantitative easing” on the part of the Federal Reserve. This is expected to result in an inflation rate of 2.4% for all items excluding food and energy and a 6.6% rate of inflation for all items in the index. These predictions are based on the assumption that techniques used by the Fed to constrain monetary inflation will see their effectiveness diminish in 2011. The spillover effect from quantitative easing are already being felt in prices for food and energy. We view this as an indicator that recent increases in the money supply are finding their way into the broad economy and influencing prices. In the event that large amounts of new money are unleashed into circulation over a short period of time, there is a considerable risk of price spikes. However, it is extremely difficult to know exactly when such an event will occur, because of the existence of large excess reserves that have been sitting on bank balance sheets for an extended period of time.

The future of consumer prices will be largely dependent on the extent to which government policy accommodates or constrains new innovation that will deflate prices for technology and manufactured goods when the currently deployed capital becomes obsolete. Our current view is that the divided legislature resulting from gains by the Republican Party in mid-cycle elections will moderate government activity and hold the potential for stabilizing the economy as it moves out beyond 2011.

Financial independence is closer than you think. Buy your Early Bird ticket to the Meet the Masters of Income Property Investing educational event before February 14 to qualify for a steep discount on tickets.

The Holistic Survival Team

Flickr / pdinnen