Market values in Phoenix are currently at approximately the same level as in the year 2000. The market area experienced a tremendous run-up during the real estate bubble and a spectacular during the financial crisis. During 2010, the regression back to fundamentals continued in Phoenix. For people who bought at the wrong time, this value contraction leverages out to a rather substantial loss. However, the current low interest rates allow buyers to generate cash flows that will help them to sustain the investment through value fluctuations until a path of growth is resumed.

Market values in Phoenix are currently at approximately the same level as in the year 2000. The market area experienced a tremendous run-up during the real estate bubble and a spectacular during the financial crisis. During 2010, the regression back to fundamentals continued in Phoenix. For people who bought at the wrong time, this value contraction leverages out to a rather substantial loss. However, the current low interest rates allow buyers to generate cash flows that will help them to sustain the investment through value fluctuations until a path of growth is resumed.

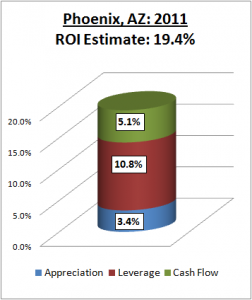

By focusing on investment in deals that produce reasonable cash flow, investors can achieve favorable rates of return from leveraged value appreciation and cash flow in the Phoenix area. Currently, approximately 54% of listings in Phoenix are foreclosures1.

Phoenix is a unique market, since it has been historically linear but was escalated to very high levels of valuation during the recent real estate bubble. We expect to see a return to historical levels of value appreciation that are a combination of modest fundamental growth and a regression upward from an artificial bottom that resulted from foreclosures after the financial crisis. To long-term investors, a steady growth rate with attractive cash flow represents a much more attractive opportunity than a cyclical market that depends on steep value appreciation and quick re-selling of properties to compensate for negative cash flow from rents.

As we move into 2011, there are two significant forces acting on the Phoenix market. The first is a regression to replacement cost after market values reach their fundamental bottom. The second is an expected increase in interest rates from historic lows that will suppress cash flow relative to prior levels. Our analysis concludes that now is the optimal time to pursue income property deals due to the intersection of historically low interest rates and market values that have been suppressed to their year 2000 levels.

Financial independence is closer than you think. Buy your Early Bird ticket to the Meet the Masters of Income Property Investing educational event before February 14 to qualify for a steep discount on tickets.

The Holistic Survival Team